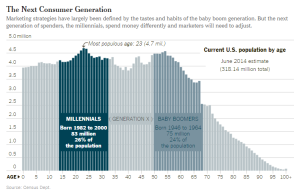

Millennials, a term that is commonly used to define the generation after Generation X, were born between the early 1980s and early 2000s. Millennials tend to get a bad rap; they are often considered to be spoiled, lazy, and even entitled. Born and raised by the affluent Baby Boomers, they grew up well cared for and provided for by a generation that has been marketed to for decades. That said, it’s not surprising that, according to The New York Times, Millennials make up about one fourth of the population and hold a good portion of the spending power.

Now these Millennials make up about 26% of the population, with the most common age being 23 (a whopping 4.7 million), and marketers need to take note. This generation was raised to expect more than their Baby Boomer parents did, who themselves were raised by parents who had been through economic depressions, war, and global change. Millennials were well taken care in their collective upbringing. They are – according again to The New York Times – the most educated generation in American history, but they are also riddled with debt. They find themselves up against major competition in the job market as well as soaring housing prices and costs of living. However, they are often unwilling to make the lifestyle changes that would, in theory, follow suit.

There are a few outcomes of the Millennials’ position. The first, while not as glamorous, is to live at home with their Baby Boomer parents. Many, in an attempt to cut costs and save money, are either choosing to not move away from home or returning home to live with their parents. A recent Huffington Post article chronicled the trend: https://www.huffingtonpost.com/2015/03/26/millennials-living-at-home_n_6878408.html

Citing a Pew study released in 2013, “36 percent of the total U.S. population between the ages of 18 and 30 were still living at home by the end of 2012.” This is not surprising given the ultra-competitive nature of landing a job among their equally well-educated peers, coupled with surprisingly low entry-level salaries. Living at home just makes sense.

The other alternative is to try and make it on their own and deal with the debt that comes with it. According to a recent eMarketer article, “US millennial internet users are in debt by an average of about $70,000.” This is at least twice the average entry level salary for their age group. The good news for this generation, who is well known for their mobile behavior, is that there are a variety of mobile apps to help them with their budgeting and investing needs.

The other alternative is to try and make it on their own and deal with the debt that comes with it. According to a recent eMarketer article, “US millennial internet users are in debt by an average of about $70,000.” This is at least twice the average entry level salary for their age group. The good news for this generation, who is well known for their mobile behavior, is that there are a variety of mobile apps to help them with their budgeting and investing needs.

It’s never been easier for Millennials to track their purchases and budget with apps like Mint, Budgt, and countless others that allows users to sync up their bank accounts and enter purchases on the go. Almost every major bank has a mobile app as well, allowing their customers to easily track spending and transactions on their accounts, which also cuts down on fraud and account issues. According to eMarketer, “nearly 59% of 18- to 34-year-old mobile phone users in the country will access their bank, credit union, credit card, or brokerage account via mobile browser, app, or SMS on their phones at least monthly this year.”

It’s never been easier for Millennials to track their purchases and budget with apps like Mint, Budgt, and countless others that allows users to sync up their bank accounts and enter purchases on the go. Almost every major bank has a mobile app as well, allowing their customers to easily track spending and transactions on their accounts, which also cuts down on fraud and account issues. According to eMarketer, “nearly 59% of 18- to 34-year-old mobile phone users in the country will access their bank, credit union, credit card, or brokerage account via mobile browser, app, or SMS on their phones at least monthly this year.”

A mobile strategy and preferably an app are not only good to have for the banking sector, but also a necessity in order to reach and stay relevant to the millennial population. In addition, given that this generation is most commonly accessing email from mobile devices, a cohesive email strategy is crucial to providing a valuable consumer experience. Use email as a way to engage with this young audience and provide insight into ways to budget, save, and plan for their future. Millennials are listening – and they need the help!

(

(