Regardless of marketing objective (awareness, initial purchase, repeat purchase, loyalty), the most efficient and effective way to drive impact in marketing and sales endeavors is to infuse data into your efforts. Today, especially among CPG companies, many have yet to embrace a holistic data-driven approach. We’ll explore why they still cling to more old-fashioned methods and lay out how focusing on a data-driven approach can make CPG marketing better.

The term “data-driven marketing” may lead some down a highly technical and overly antiseptic marketing path, but we are advocates of finding and nimbly using quality data to uncover business insights, develop more impactful marketing, and fuel business growth. The end result? Higher revenue, greater return on investment, and better overall consumer relationships.

Although 81% of overall marketers expect the majority of their decisions to be data-driven by 2020, CPG has dragged its feet. Sure, as a group, CPG may have been among the first to employ targeted data-driven media solutions; and most, if not all, CPG companies use data to drive decisions at the retail sales level. Yet, they have lagged in full organization-wide efforts to make consumer relationships and data foundational to their operations.

The challenge for CPG brands has nothing to do with being unable to see the future and everything to do with access to customer data.

The lack of complete adoption of data-driven marketing by CPG is somewhat ironic. CPG brands became ubiquitous in the 1950s and 1960s when companies like Procter and Gamble, General Mills, and Unilever developed the discipline of brand management. This more modern marketing methodology was founded on the idea that marketplace success was determined by understanding the consumer better than the competition. Getting the total brand mix right was the key to growth, and it ushered in an era where many of the brands we know and love today became widespread. Consumers trusted brands and retailers restocked their shelves to accommodate demand, leading to what some call the Golden Age of Marketing (ever watch Mad Men?).

The same fuel behind the growth of modern CPG brands may be the reason for the industry lagging on current data-driven marketing best practices. Yes, brands can undertake studies to help understand the consumer and shopper, but they have no real insight into who is actually buying, how much they’re buying, and when and where they’re buying.

CPG brands have taken two primary paths to solve this data gap.

Many brands have invested in CRM (customer relationship management or marketing) efforts to include loyalty programs, which reward consumers for buying the brands. Two of the most notable over the past decade are Kellogg’s Family Rewards and My Coke Rewards. The benefit of these reward-for-buying programs is the purchase insight brands gain. The downside, however, is that the rewards for purchase become an incremental expense. Other efforts from CPG brands (not tied to points for purchase) include email programs and, to some extent, social media audience building. Historically, this type of program has been successful. In fact, according to IRI, CRM program members are 36% more likely to remain engaged with your brand, buy your brand 5% more often, and spend 14% more on your brand.

E-commerce is becoming a prevalent consumer activity, thanks to ease and convenience. Experts predict that by 2025, 10% of global fast-moving consumer goods sales will be via digital channels, with US online grocery sales reaching 20%. It’s imperative for CPG brands to embrace this model, as it’s where growth exists. Rather than relying on third-party retail partners (whether it be via Amazon or Walmart.com), many CPG brands have created their own direct-to-consumer (DTC) e-commerce programs to acquire and use customer data to boost digital sales. While this model helps create a boon of transactional data, CPG brands typically cannot compete at scale in DTC due to infrastructure and supply chain requirements, the high cost of customer acquisition, and the competition from – and consumer appeal of – one-stop shops like Amazon.

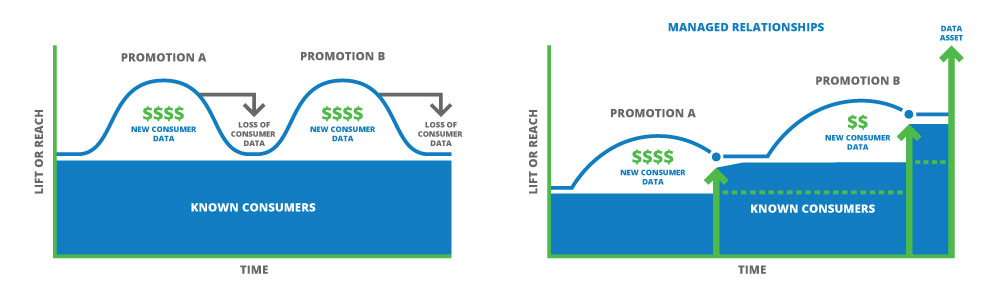

Loyalty programs, email, and e-commerce efforts can be highly successful tactics to help brands overcome inherent data gaps and develop better insights to support growth. However, they are only part of the solution.

Instead of thinking of CRM as a program, we advocate that the more significant value is to view the consumer relationship as the overarching objective. Rather than a series of campaigns or programs driven by different silos in an organization, enterprise-wide marketing should help create a more valuable relationship with each consumer/customer over time.

When every interaction adds value – for both parties – the relationship improves incrementally. The ultimate objective? To provide consumers what they need when they need it. If done right, maybe brands can even do this before consumers know what they need.

When viewed at a macro level, the more touchpoints accumulated, the more opportunity for insights and marketing optimization. Organizations should look for opportunities for audience data enhancement and enrichment, including consumer information, activities, and preferences. Brands should work with partners and platforms to build an enterprise-wide customer relationship model that brings second- and third-party data together with their first-party data. By linking online behavior data to purchase data (either directly or via data partners), a 360-degree view is possible, which can deliver a more relevant member experience. This also requires deep human insights to understand and implement behavioral data-driven retention and acquisition strategies.

In a data-driven world, where consumer and customer insights are now the foundation of seamless shopping experiences, CPG brands need to take control of the customer relationship, their data, and their destiny. Investing in the consumer/customer relationship as a core objective – versus on a program by program basis – will result in more significant omnichannel sales growth.

(

(